Sustainable lending: a breakthrough or a gimmick?

Back to Banking Law Committee publications

Lukasz Szegda

Wardynski & Partners, Warsaw

lukasz.szegda@wardynski.com.pl

The scale of investment needed in the upcoming years to combat global warming and to achieve the European Union’s ambitious environmental targets is massive. It by far outstrips the capacity of the public sector. Thus, along with governments, regulators and people as consumers, the financial industry also has a significant role to play. Industry organisations, including the Loan Market Association (LMA), which is a key player in the syndicated loan markets in Africa, Europe and the Middle East, are becoming involved in the process of stimulating such changes.

After the publication of its Green Loan Principles (GLPs), the LMA decided to further boost the green trend. As global challenges require a global response, the LMA has developed recommendations on sustainability-linked loan principles (SLLPs)[1]along with its counterparts in other regions of the world – the Loan Syndications and Trading Association (LSTA) in North America and the Asia Pacific Loan Market Association (APLMA). Originally published in March 2019, the SLLPs were updated in May 2020 and supplemented with the Guidance on SLLPs[2] which provide further clarity on the application of the SLLPs and practical considerations for SLL documentation. The purpose of the SLLPs was to boost market use of innovative sustainable loans and they seem to have succeeded.

Sustainability-linked loans and other green financing

The aim of including these products in banks’ offerings is similar to that of green loans. They should encourage borrowers to pursue environmentally-friendly activity and achieve other socially responsible aims. However, in the case of sustainable loans the emphasis is not put on ‘green’ use of proceeds but rather at improving borrowers’ sustainable profile by incentivising them to achieve ambitious sustainability targets. For achieving these targets, borrowers are to be ‘rewarded’ by a reduction in the margin.

Unlike classic green loans, the proceeds from sustainable loans do not have to be used for green projects. Nor is it necessary to separate the proceeds of such loans into dedicated accounts and monitor their use (as in the case of green loans). They can be used for the borrower’s general corporate purposes. On the other hand, the margin step-down incentive is not a key element in green loans. Notwithstanding these differences, it is possible for a loan to be structured as SLLP-compliant and aligned with the GLPs at the same time; however such transactions are rare in the market.

In addition to GLP-compliant loans, there are also loans supporting environmental considerations (eg, mass transit) but that are not fully aligned with the LMA’s Green Loan Principles.

Sustainable loans market

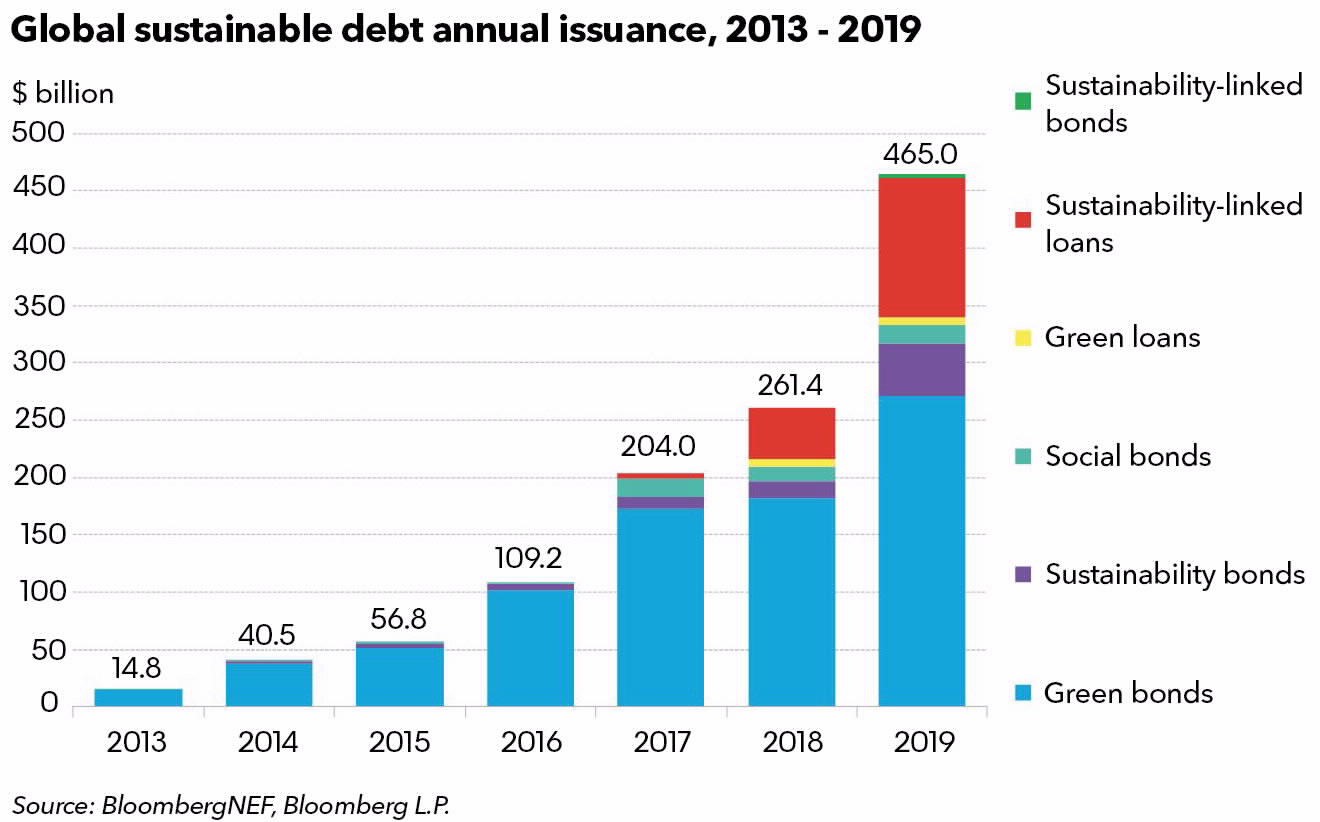

Last year saw record volumes of widely understood sustainable debt. According to BloombergNEF, the volume of sustainable debt issued globally in 2019 increased by 78 per cent, hitting $465bn.[3]This figure combines a variety of sustainable debt instruments, from green bonds and green loans to sustainability-linked loans, with the latter growing 168 per cent year-on-year to $122bn.

The breakthrough year had a spectacular finish on the sustainability-linked loan market with Royal Dutch Shell plc securing a $10bn sustainable revolving credit facility provided by a syndicate of 25 banks.[4]

Given that following ratification of the UNFCCC Climate Agreement in 2016 (known as the ‘Paris Agreement’) and publication of the UN Sustainable Development Goals (SDGs) in 2015 companies have been increasingly active in shaping their green and sustainable strategies, the loan market recognised that sustainability-linked loans may have a number of advantages both for borrowers and for lenders. The advantages range from building stronger relationships with stakeholders and reputational benefits, to promoting sustainable long-term growth and profitability.

As Jonas Rooze, sustainability analyst at BloombergNEF, explained: ‘The steep increase is fuelled by end-investors’ concerns about the threat of climate change, and the desire of many big company, bank and government leaders to be seen as behaving responsibly.’[5]Indeed, increasing investors’ interest is reflected by a network of more than 7,000 corporate signatories to the United Nations-supported Principles for Responsible Investment collectively reporting more than $80tn in assets under management.

The sustainability feature can apply to all types of loan products, mainly revolving loans but also term loans (including leveraged transactions), as well as contingent facilities (eg, guarantee lines or letters of credit).

As evidenced by the increasing number of market examples, sustainability-linked loans are applied across a wide range of industries and sectors, such as energy (as in the Shell example), utilities,[6]telecommunications,[7]agriculture,[8]fashion,[9]packaging,[10]chemicals,[11]shipping,[12]aviation,[13]education,[14]hotels[15]and real estate.[16]Notably, thanks to their flexibility and lack of restrictions on use of proceeds, sustainability-linked loans have a great potential for a much wider market spread (in terms of range of borrowers and sectors) than green loans.

The loan market’s innovation of sustainability-linked loans has been also adopted by the bond market with the landmark $1.5bn Enel’s issuance directly linked to the UN Sustainable Development Goals (SDG-linked bonds).[17]Further alignment of bond and loan markets in green and sustainable products will be needed.

Impact of Covid-19

Obviously, the ongoing Covid-19 outbreak is having a significant impact on sustainable lending. Not surprisingly, available data for 1Q20 show a sharp decline in volumes as compared to 4Q19[18]. As green initiatives are not critical for companies’ day-to-day existence, in the short term resources are more likely to be allocated to post-Covid recovery in general at the cost of, among others, green and sustainable policies. Rapid and unpredictable changes limit companies’ ability to plan or achieve sustainability targets. Moreover, the pandemic has resulted in a temporary reversal of sustainability trends with certain pollution enforcement relaxed, customers rejecting reusable grocery bags as unsanitary and cities reversing throwaway plastic restrictions.

However, in the long run, the sustainable finance market is likely to gain new momentum. As some research shows, climate change (in addition to globalisation and urbanisation) is one of the key factors fuelling the increased incidence of epidemic outbreaks. Dramatic disruption to supply chains is likely to lead to the shortening of supply chains in the future and making them more environmentally friendly. Virtual meetings show executives that they can reduce travel and limit air pollution. The crisis has exposed a lack of resilience for global risks (even those that might be expected, such as epidemics) at many companies and companies may be keener to prepare for various climate change scenarios. In addition, corporate and social responsibility issues have frequently been on many management agendas during the pandemic. According to some reports[19], executives may use Covid-19 ‘as an opportunity to lean in on sustainability, as the pandemic has highlighted the importance of critical ESG factors.’

A similar approach has been recently presented by the European Commission[20]. According to the Commission, ‘the ongoing COVID-19 outbreak shows the critical need to strengthen the sustainability and resilience of our societies’ and that ‘similar health emergencies are likely to arise in the future as climate and environmental impacts escalate’.

Nature of SLLP-compliant loans

The SLLPs are intended to set a market standard that will consolidate the practice and spread a high-level framework for functioning of sustainability-linked loans to a broader group of market participants. While the LMA standards are only non-binding recommendations, they have a great impact on the market.

The basic presumption of the SLLPs is for the potential borrower to meet selected sustainability performance targets (SPTs), which are metrics to be maintained at a pre-determined level during the loan term. Examples of SPTs are listed in an appendix to the SLLPs. The proposed targets include water saving, improvement in energy efficiency, increases in the amount of renewable energy generated or used, and reduced greenhouse gas emissions. Some of the targets are not immediately related to environmental protection, such as the development of affordable housing units and improvement in occupational health and safety conditions.

The appendix gives only examples, and in a specific transaction the parties can agree on other targets, such as reductions of unprocessable waste. Once SPTs that are satisfactory for the borrower and the lender are set, meeting the targets during the term of the loan is primarily incentivised by reduction in margin. Over the longer term, this will also allow business models to be adapted to environmental standards, attracting new investors and positively contributing to the reputation of businesses and banks.

Components of the SLLPs

The SLLPs comprise four main components that should be displayed by businesses in their efforts to achieve sustainable growth:

Relationship to borrower’s overall sustainability strategy

The first step is presenting the borrower’s overall sustainability strategy (or environmental, social and governance (ESG) strategy) and demonstrating how the SPTs correspond to the adopted sustainability/ESG aims. Borrowers are also encouraged to identify any sustainability standards or certifications they are seeking to attain.

Setting sustainability performance targets (STPs)

The SLLP recommendations assume that the STPs will be negotiated and set between the borrower and lenders for each transaction. A borrower may arrange its sustainability-linked loan product with the assistance of a sustainability coordinator or sustainability structuring agent, typically appointed from among the consortium banks. Targets may be set based on the borrower’s internal strategy or with the advice of an independent external entity, with regard to market criteria. Such an independent opinion confirming the appropriateness of the adopted SPTs may be indicated in the loan agreement as a condition precedent to utilisation of the loan. This is a crucial part of the process and requires knowledge of the benchmarks typical for the targets relevant to the industry in question.

It is important to strike the right balance between targets that are meaningful – meaning core to the borrower’s business – and ambitious – meaning that they represent a true reach for the borrower, but are also flexible. Various studies[21]indicate that selection of ESG factors in the areas where a given company has the greatest impact on society and environment and that are relevant to its core business could result in the best societal returns. On the other hand, companies merely focusing on the reputational benefits of the product may tend to adopt a broad spectrum of ESG scores without regards to the casual link to the company’s core business, just to check the boxes, boxes that unfortunately are not material to economic performance and social progress. Difficulty in identifying proper targets and setting realistic levels may be factors that discourage borrowers from seeking loans of this type. In this context, industry standards and independent organisations (eg, the Sustainability Accounting Standards Board[22]) may be of assistance to borrowers in selecting STPs that are sufficiently meaningful and ambitious.

Confirmation that an SPT has been achieved during the loan term triggers a reduction of the loan margin (initially set at a level similar to other loans on the market). Conversely, failure to achieve a target may result in an increase in the financing cost. The latter case may raise the question of whether failure to achieve a target is a result of insufficient efforts by the borrower or is due to setting overly ambitious targets. As stated in the SLLPs: ‘By linking the loan terms to the borrower’s sustainability performance, borrowers are incentivised to make improvements to their sustainability profile over the term of the loan.’

Reporting

During the course of repayment, the borrower must present its progress in achieving the adopted targets (such as any external ESG ratings). To ensure transparency and credibility, businesses are encouraged to report their results publicly to the market. If confidentiality is required, the borrower should at least share its results (together with the methodology and assumptions) privately with all of the lenders.

Review

Assessment of the achievement of the indicated SPTs is determined on a transaction-by-transaction basis. If the borrower does not publish its market data and does not have staff qualified to make such assessments, it is desirable to engage an external, independent consultant to assess the borrower’s performance against the adopted targets at least once per year. In most transactions of this type, the banks have required the engagement of an external expert.

An alternative could be to develop internal performance reporting comparing the targets set and achieved. Particularly in the case of public companies that share their market data, a communiqué from the company based on an internal review may be sufficient for the bank. In any case, it must fairly present the methodology for the calculations. On this basis the bank will assess the borrower’s effectiveness in fulfilling the lending conditions, which is the basis for determining the cost of the credit.

Sustainable finance regulations

Measures such as the SLLPs adopted by the lending industry complement the broader governmental and regulatory measures, particularly at the level of international institutions.

To foster the shift in capital allocation, a number of measures at EU level, including regulatory initiatives, have been undertaken. The European Commission’s Action Plan on Sustainable Finance, launched in March 2018, was aimed at ‘reorient[ating] capital flows towards sustainable investment in order to achieve sustainable and inclusive growth’.

The backbone of the sustainable finance regulatory package is the EU taxonomy[23], an EU classification system determining activities that can be regarded as environmentally sustainable, providing for further standardisation and addressing the problem of the ‘greenwashing’[24] of non-sustainable financial products. Together with the sustainable finance disclosures regulation[25]and the sustainable and finance benchmarks regulation,[26]they constitute the core of the EU regulatory package in this area.

Summary

Sustainability-linked loans expand the set of pro-ecological products offered on the financing market. The market for such loans is at the early stage of growth and requires further measures aimed at standardising the product, data standards and metrics for assessing attainment of sustainability performance targets.

Hopefully, if more thoughtful selection of sustainable targets and the contemplated regulations manage to limit the risk of ‘greenwashing’, which remains a key concern for the market, and if the transparency of the product is improved, the market has a strong potential for further growth. Although the Covid-19 outbreak has had a negative impact on the market in the short term, the long term perspective is positive, as arguments presented above show. I trust that along with increasing awareness by companies and investors of the environmental impact of their operations, loans of this type will be used more frequently not only in Europe but also in other key financial markets.

As one banker remarked, the market should reach a stage where instead of asking why do a sustainable deal, credit committees would ask why do a non-sustainable loan.

[8]See Louis Dreyfus Company, ‘Louis Dreyfus Company Secures Its First Asia Sustainability-linked Revolving Credit Facility’ (26 August 2019), www.ldc.com/global/en/investors-media/news/pre/louis-dreyfus-company-secures-its-first-asia-sustainability-linked-revolving-credit-facility accessed on 5 February 2020.

[12]World Maritime News, ‘NYK Obtains Japan’s 1st Sustainability-Linked Loan’ (2 December 2019) https://worldmaritimenews.com/archives/287206/nyk-obtains-japans-1st-sustainability-linked-loan accessed on 5 February 2020.

[15]Pilar Martínez Fariña, ‘BBVA signs first-ever sustainable project finance loan in Spain's hospitality industry’, BBVA (11 December 2019), www.bbva.com/en/bbva-signs-first-ever-sustainable-project-finance-loan-in-spains-hospitality-industry accessed on 5 February 2020.

[18]https://www.environmentalleader.com/2020/04/covid-19-causes-major-downturn-in-sustainable-lending/ accessed on 19 May 2020.

[20]https://ec.europa.eu/info/consultations/finance-2020-sustainable-finance-strategy_en accessed on 19 May 2020

[22]https://www.sasb.org/ accessed on 19 May 2020.

[23]On 9 March 2020, the TEG published its final report on EU taxonomy: https://ec.europa.eu/info/publications/sustainable-finance-teg-taxonomy_en accessed on 19 May 2020.

[24]‘Greenwashing’ or ‘sustainability washing’ is a situation where claims on sustainable credentials are misleading, inaccurate of inflated, either through (1) STPs that are not sufficiently ambitious or meaningful or (2) through inaccurate monitoring or measuring of STPs (see section 2.G of the LMA’s Guidance on SLLP).

[25]Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector, https://eur-lex.europa.eu/eli/reg/2019/2088/ojaccessed on 5 February 2020.

[26]Regulation (EU) 2019/2089 of the European Parliament and of the Council of 27 November 2019 amending Regulation (EU) 2016/1011 as regards EU Climate Transition Benchmarks, EU Paris-aligned Benchmarks and sustainability-related disclosures for benchmarks, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex:32019R2089accessed on 5 February 2020.

Back to Banking Law Committee publications