The many uses and benefits of a variable capital company

Back to Securities Law Committee publications

Jerry Koh

Allen & Gledhill, Singapore & Vietnam

jerry.koh@allenandgledhill.com

Jonathan Lee

Allen & Gledhill, Singapore

jonathan.lee@allenandgledhill.com

Introduction

Since the introduction of the variable capital company (VCC) framework in Singapore in January 2020, there have been close to 160 VCCs established as of the end of October 2020. The strong take-up in a relatively short period of time against the backdrop of the Covid-19 pandemic has been encouraging and bodes well for Singapore’s push to be an asset management and fund domiciliation hub.

This also comes amidst continued growth in Singapore’s asset management industry. According to the 2019 Singapore Asset Management Survey by the Monetary Authority of Singapore (MAS), Singapore’s assets under management grew by 15.7 per cent in 2019 to reach US$2.9tn, with growth across both traditional sectors (such as stocks and bonds) and alternative investments (such as private equity, venture capital and real property).

While Singapore has long been attractive for fund and asset managers given its transparent and stable regulatory environment, ease of doing business and access to a skilled and educated workforce, the introduction of the VCC has given them a flexible fund vehicle to not just house fund management activities and operations in Singapore, but to also ‘onshore’ their funds in Singapore.

The flexibility of the VCC allows it to be used in creative ways across different fund strategies, investor classes and asset classes. This article shows some different ways in which the VCC can be employed and utilised.

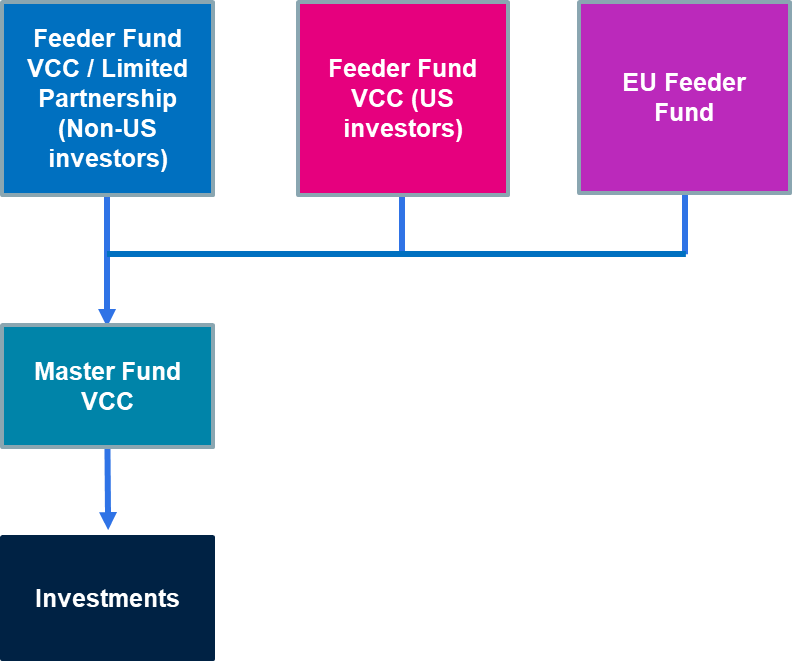

Master feeder structures

In line with the policy intent for the VCC to be used as a collective investment vehicle, the MAS had originally required a VCC to have at least two shareholders. However, following feedback during the consultation process, this requirement was removed, and a VCC can now have just one shareholder. There is also no restriction against a VCC holding a single asset. This would essentially allow the VCC to be used as a master fund with one or more feeder funds or as a feeder fund itself.

Operationally, certain other features of a VCC, such as the flexibility to redeem capital at a redemption price equal to its net asset value and the ability to make distributions from its assets instead of only out of profits, also lend themselves well to using a VCC as a master pooling vehicle that facilitates ease of returning capital and returns from the underlying investments to the investors. This compares favourably with using ordinary Singapore companies as master fund vehicles due to the more cumbersome procedures for capital reduction and requirements for paying dividends only out of profits that apply to ordinary companies.

The diagram below illustrates how different feeder funds (whether structured as VCCs or other legal forms) can be used to feed into a VCC master fund.

For example, a VCC can be used as a feeder fund for US tax-resident investors to invest into a VCC master fund, where both the master fund and feeder fund make US ‘check-the-box’ elections to be treated as transparent for US federal income tax purposes.

To allow European investors to access the VCC master fund, a European feeder fund vehicle which is compliant with the European Union Alternative Investment Fund Managers Directive (AIFMD) can be set up to invest into the master fund.

Similarly, given strong investor familiarity in limited partnership structures in traditional offshore jurisdictions such as the Cayman Islands, particularly for private equity funds, a limited partnership feeder fund (whether offshore or in Singapore) can be established to invest into the VCC master fund.

The flexibility of the VCC allows it to be utilised creatively to accommodate different master feeder structures for different purposes.

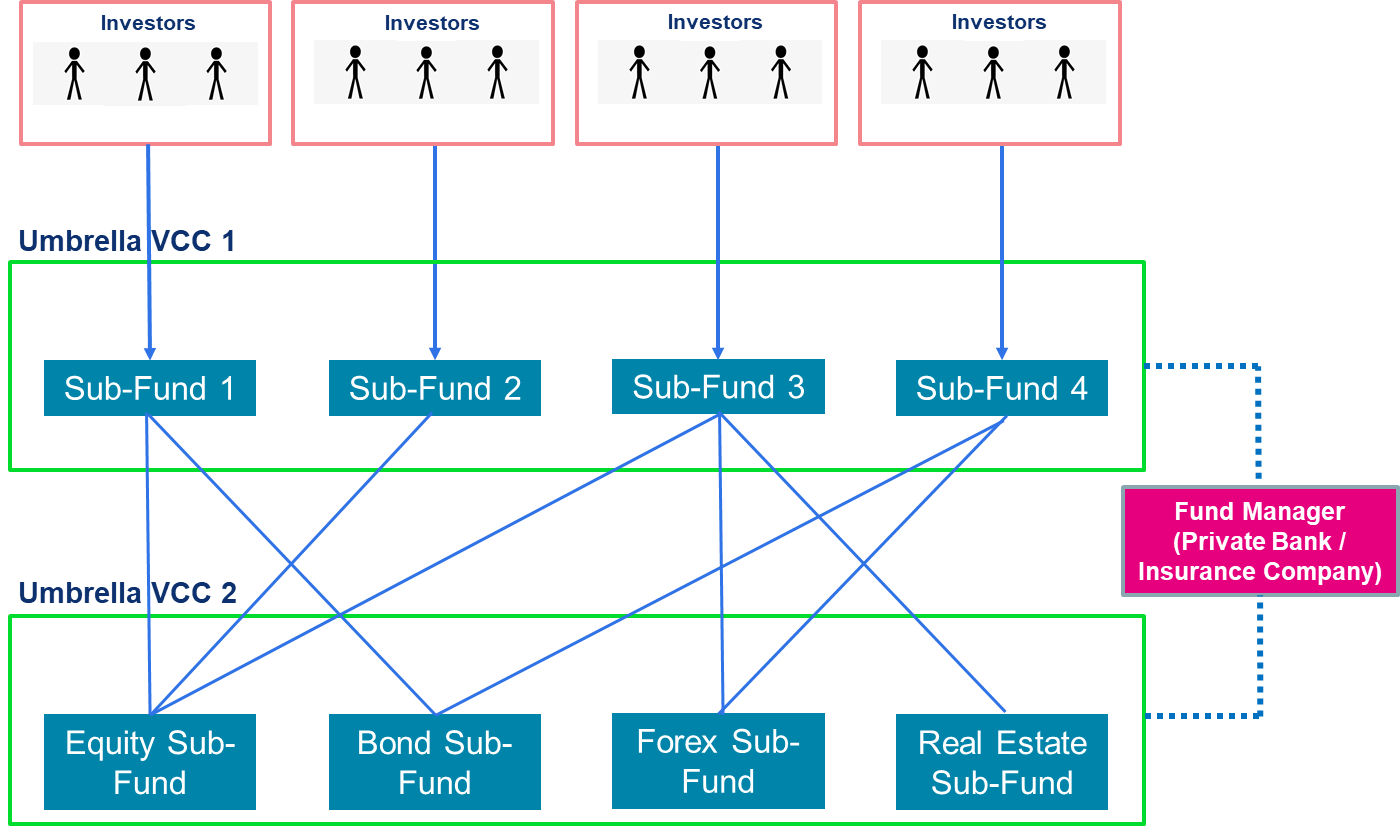

Wealth management and asset allocation

VCCs are able to adopt umbrella structures with multiple sub-funds that enjoy legal segregation of assets and liabilities between each other, notwithstanding that they are housed within a single legal entity.

This allows fund managers to pool investors according to their objectives and manage and allocate monies across different asset classes in a way that is most appropriate for each investor. The ability for capital from VCCs to be easily redeemed at its net asset value allows for open-ended structures where redemptions and re-allocations can be carefully managed to ensure liquidity.

The diagram below shows how the VCC may be utilised by fund managers and private banks to give wealth management customers the ability to gain exposure to a range of different asset classes, through allocations into sub-funds with different strategies, according to their individual requirements.

For fund managers, this also creates potential economies of scale arising from efficiencies of pooling of funds and investments together as well as structural efficiencies, such as having common service providers and directors across the sub-funds.

Licensed banks and insurance companies are permitted to manage a VCC and such structures may be ideal for private banks managing the assets and investments of their high-net-worth clients, as well as insurance companies adopting diversified portfolio investment strategies.

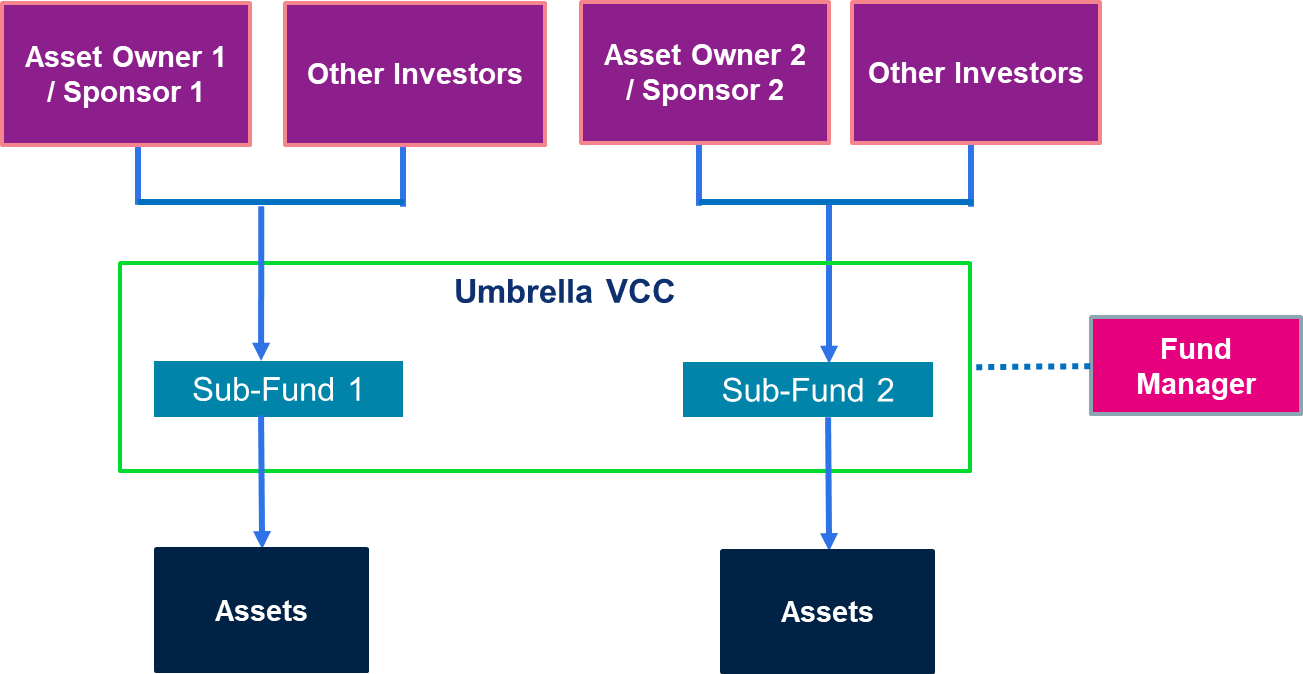

‘Plug-and-play’ model

The ability to quickly add sub-funds under an umbrella VCC potentially allows a fund manager to offer a platform for sponsors/asset owners to easily securitise and unlock value from their assets by seeding their own sub-fund and appointing the fund manager to manage the sub-fund on their behalf. Some sponsors/asset owners may not have the resources to establish and manage their own funds and may want to focus on their core businesses. Fund management, being a regulated activity, would also require ongoing compliance and other costs to be incurred. Having a VCC as a platform allows a fund manager to essentially ‘lease’ a sub-fund and provide all the necessary fund management infrastructure to the sponsor/asset owner to allow it to seed its own sub-fund with its assets, find third party investors and monetise its assets. This is illustrated in the diagram below.

Although the sponsor/asset owner may lose some control over the assets with the introduction of a third-party fund manager, it would not have to incur time and costs to deal with fund formation, compliance, licensing and regulatory issues and administration of the fund, but would still be able to enjoy the economic benefits of monetising its assets. The sponsor/asset owner would also be able to leverage the contacts of the fund manager to source for new investors.

Platform for real estate/infrastructure/PE funds

While, traditionally, alternative strategy private funds, such as real estate, infrastructure and private equity funds, have adopted closed-end limited partnership structures, the VCC could work as an alternative structure as it potentially offers certain structural advantages which may be useful in such alternative funds. These include the following:

-

Sub-funds with different assets and different investors: It is a common request for investors to want to have the right to be excused or to opt-out of certain investments. This sometimes presents difficulties in a single blind-pool fund structured as a standalone vehicle like a limited partnership, which may only be able to afford contractual protection in excluding specific investors from certain assets and liabilities. An umbrella VCC would be able to ensure a stronger degree of protection by separating assets into different sub-funds, which would have the benefit of the statutory protections under the VCC legislation in terms of segregation of assets and liabilities between sub-funds.

-

Open-ended structures: While typically real estate and infrastructure funds are closed-end funds given the illiquid nature of their underlying investments, an increasing number of real estate and infrastructure funds now provide for more flexibility for investors to exit and may want to allow for similar mechanics as open-ended funds to allow more frequent redemptions by investors. This may be the case especially where the assets have stabilised and are income-producing. Although a VCC can be used as a closed-end fund, its flexible capital structure may be particularly well-suited for use as an open-ended vehicle in such cases, given the ability to easily redeem capital at net asset value.

-

Tokenisation: Being a corporate structure with investors holding shares of the VCC may lend itself more easily for tokenisation of the securities of the fund, compared to partnership interests which are essentially contractual rights. Tokenisation and offering of VCC shares as digital securities potentially enhances liquidity for alternative funds by allowing interests in the fund to be traded on a secondary market. It is also highly divisible and can allow investors to buy tokens which represent a fraction of the underlying assets, lowering minimum investment tickets and tapping into a wider pool of investors.

Conclusion

The early adoption and take-up of the VCC structure thus far has been a very promising development for the Singapore funds industry. Its features, such as its easily varied capital structure, ability to adopt an umbrella sub-fund structure and availability across all types of fund strategies, offer fund managers and investors significant flexibility in its use. The MAS has also not rested on its laurels and has actively encouraged the use of the VCC, including offering a grant scheme to co-fund 70 per cent of the qualifying expenses incurred in establishing, or re-domiciling a foreign corporate entity into, a VCC (up to S$150,000 per VCC). Such qualifying expenses include the expenses incurred towards paying for legal, tax, fund administration and regulatory compliance services.

The flexibility of the VCC allows it to be used in both traditional fund structures as well as in creative and innovative ways. As more fund managers and investors make use of the VCC and see its many benefits, the authors see it becoming a mainstay and an established fund vehicle in time to come.

Back to Securities Law Committee publications