Key messages relating to the world of startups

Back to European Regional Forum publications

A summary of sessions from the 4th Annual IBA European Startup Conference, which took place on 20 November 2019 in London. The Conference brought together Europe’s leading startup, growth company and venture capital lawyers. It covered a wide range of topics and heard from entrepreneurs, founders, dealmakers, lawyers, investment bankers, academics and investors with first-hand experience of high profile startup companies and deals.

Keynote address

Speaker

Chris Adelsbach Techstars, London

Key points from the keynote address included:

• pushing against the grain isn’t always bad;

• the market needs to be ready for the product to grow naturally;

• focused and goal-oriented team is one of the most important parts of a startup; and

• European startup ecosystem is in a great place.

Chris Adelsbach, Tech-Star’s Venture Partner, has been living in London for more than 15 years. He has always thought that pushing against the grain was a good thing and that’s what lead him to startups. Chris is very successful in what he has achieved, knowing that a good mentor must be willing to give up their time, requesting nothing in return.

The problem with startups is their uncertainty, and recognising ones with good potential require training your gut feeling. The idea needs to be able to scale and the market needs to be ready for the product to grow naturally. Since it takes a few years for the startups to be successful, an energetic and focused team is everything.

Chris is currently into Techstar, which is a worldwide network helping entrepreneurs succeed. They have invested in 2,000 potential businesses, many of them such as Uber, are now known worldwide. By having US$8.5bn of following capital, Tech-Star is one of the largest and most successful business accelerators.

For anyone looking for involvement, Europe’s startup ecosystem is blooming with many likeminded people and potential opportunities.

Digital healthcare

This session looked at companies and issues in digital health: one of the fastest growing sectors of healthcare, which will have a huge impact on our lives in the future.

Session Chair

Alexandra Richardson Taylor Wessing, London

Speakers

Lorin Gresser Dem DX, London

David Porter Apposite Capital, London

Katie Webb General Counsel, Touch Surgery, London

Key points from this session included:

-

digitalisation is required for efficient healthcare;

-

nurses need to be able to treat patients;

-

the legacy mind-sets need to change to allow greater development; and

-

even with new tech, patients’ data needs to be protected.

Everyone wants better healthcare and digitalisation is required to make it more efficient and available to everyone. The most relevant current problem is the shortage of doctors, especially in developing countries. Nurses could help, but often lack the required knowledge. Digitalisation could be used to create tech solutions for nurses, providing them with the necessary information and guidelines.

Another modern problem is the legacy mind-sets. The doctors of today need to get more up to date and be open to change, since it would improve the lives of their patients.

Among the greatest challenges in digital health is regulations, as patients’ data needs to be protected. Ever-evolving technology needs to be able to progress quickly while still being able to regulate itself to prevent misuse of sensitive data.

European ecosystems

Session Chair

Robrecht Coppens Loyens & Loeff, Brussels

This session focused on some European hotspots in terms of interesting developments and built on our knowledge of previous conferences, such as our first conference where we focused on Dublin, Israel and Silicon Valley, and our most recent where we learnt about the Berlin ecosystem.

This conference covered Vienna and the Scandinavian ecosystems. Delegates heard from the Legal Tech Hub Vienna, which is a collaboration of law firms partnering with young legal technology companies to help them develop their service and products. The session also covered what is hot and emerging in the startup world of Scandinavia.

Vienna as the legal tech hub

Speakers

Stefan Artner DORDA Rechstanwaelte GmbH, Vienna

Niels Martin Brochner CEO and Founder, Contractbook, Copenhagen

Key points from this session included:

• as a legal hub, Vienna provides accelerator opportunities;

• client feedback is key; and

• law firms should think ahead with their digital strategy.

Vienna is one of the world’s leading tech hubs. It provides accelerator opportunities, while helping with proof of concepts. In forming the legal hub, the aim was to create something that could not be undertaken by competing individual law firms.

The accelerator is a five-month programme for startups. Its objective is to lead the legal consulting sector into the digital future.

The best strategy for law firms wishing to adopt digital innovation is through a combination of partnerships between law firms and legal tech startups. Another idea is combining the developments of established software players and law firms with buy-and-adopt strategies. Client feedback is also key, by committing to giving feedback, you can keep the standards, build the product and develop the technology.

Contractbook is a platform which allows users to create and store their documents. The tech hub of Vienna approached Contractbook, who took up the collaboration. Contractbook had raised money from United States venture capital firms.

Europe may at times feel like the underdog in US-Europe relations, but it is key for tech solutions being tailor-made for European markets. Law firms should think of their digital strategy for their next five years and of the low hanging fruit (eg, contract development, storing and administration). Subsequently, they should move on to more complicated steps (eg, complex legal due diligence tools).

Hot and emerging in the Scandis

Speakers

Ulrika Viklund Co-founder Northworx, House Be, E14 Invest and Spira, Stockholm

Victoria Kopylov Kry, Stockholm

Key points from this session included:

• collaboration by innovative and interested regulators is the key for the tech niches to continue to grow and develop;

• the Scandinavian markets are interested in ‘do-good’ startups;

• taxation and incentives can be useful for startups to attract talent;

• competition is healthy but the collaboration of hard competitors in a particular market, such as legal, can lead to fruitful initiatives in the tech field relating to that market; and

• funding and client feedback remain key features for startups to expand and build their products, services and business.

Scandinavian markets are most interested in impact investments and do-good startups. Although there is a focus on profits in the Nordics, many want to have a positive impact too. This started with a number of successful entrepreneurs who have now focused on purely do-good startups to give back to the community. In Sweden there is much eco-anxiety among the young that can be either a block or a driver in creating major influences in the future.

Sweden and the Nordics are a truly digital market and it is very easy to reach people on a daily basis. This helps individuals interact with corporate in a safer and more confident way, encouraging further initiatives, eg, a safe data processing app developed by the digital healthcare provider being accepted by banks makes people feel that their data is more secure.

The med-tech sector, with the concept of digital healthcare, has experienced some fantastic developments. The main theme would be artificial intelligence (AI), and how it can be used to reduce human error. Many med-tech services provide assistance with decision making, but one of the main concerns from a legal perspective with AI in the medical sector is going to be the attribution of responsibility for procedure, since the concept of attributing responsibility to machines is a difficult issue in itself.

Employment is also an issue, given that the sector attracts talent from all over the world. Taxation initiatives could help in attracting talent, but other incentive concerns remain. Sweden’s new employee incentive scheme is aimed at small companies with low revenues which is excellent but once a certain level of growth has been reached, the incentives no longer applies. Managers and founders therefore face challenges to incentivise employees in such cases.

London trends

The London startup ecosystem is, by many measures the most important in Europe. The panel of participants in this ecosystem, including startup founders and investors who focused on current trends in London and their expectations for the next few years.

Session Chair

Steve Barnett Shoosmiths, London

Speakers

Tahreem Arshad Sozie, London

Luke Hakes Octopus Ventures, London

Hugo Silva Pi Labs, Lisbon

Key points from this session included:

• founders are looking for more than just money, namely connections and mentoring;

• the monetary product has to develop and grow to meet founders’ needs;

• there is more competition for venture capital and funds, as US funds are moving into the London market;

• there are increased opportunities for founders and entrepreneurs;

• London may consider bolstering the support it gives startups at their initial stages in business;

• founder diversity should become more of a focal point;

• founders are becoming increasingly savvy; and

• for lawyers,simplicity, speed of execution and commerciality are key in startup venture capital deals.

Since 2008 there has been a huge explosion in venture capital, from four or five key funds, to multiple funds which are much more specialised in terms of stage, sector and location. There has also been a change in the products which venture capitalists are offering to entrepreneurs in the marketplace – a necessary evolution due to the development of the marketplace. Capital is no longer sufficient on its own but there needs to be peer-to-peer learning, operational expertise and other value-added services which assist winning the best deals.

London has come a long way from meeting the non-monetary needs that founders need. Venture capitalists and accelerators run varied programmes with valued partners. Their founders are seeking connections and non-monetary assistance as much as they are looking for money.

Many large US funds are starting to establish businesses in London, gearing up competition and bringing US capital to London, which in itself is more specialised, larger, less price sensitive and quicker in dealing. This will probably drive a new tier of funds and second wave of fund dynamics evolutions in London.

When the Fintec wave comes to an end, London will need to decide on a new trend- potentially AI, albeit a classification of what AI actually is, and actually infusing AI into products may be elusive. There definitely is a new wave, as the Fintec space is crowded in London, although there is still room to move. This will lead to a new wave of revenue, once the next trend has started.

Part of the London ecosystem’s attractiveness is that it still has the ability to tap into existing opportunities in other jurisdictions which is potentially good for founders but not necessarily great for the venture capitalists and funds with added competition. Although admittedly, the ambition levels of London founders may not yet be as high as they could be as they still tend to sell too early. This may well be due to little support in London at the initial stages of the startup where value is being built before fund raising.

The investors’ perspective: London’s outlook on pan-European investment opportunities

In this session, London-based venture capital financiers shared their thoughts on the pan-European investment trends and opportunities.

Session Chair

Richard Burrows MacFarlanes, London

Speakers

Jemma Bruton Hambro Perks, London

William McQuillan Frontline Ventures, London

Andrew Wigfall Balderton, London

Key points from this session included:

• the number of funds across the European Union has increased extensively in the last couple of years;

• the speed of the transactions is increasing, in the United Kingdom there are standard BVCA (British Private Equity & Venture Capital Association) documents, which aim to create an efficient investment process;

• Brexit will cause an operational cost for startups, as recruiting from abroad will become more expensive and complicated;

• onboarding an employee will take more time – the percentage of people going from university to work for a startup has increased;

• there are good EU startup success stories, which is generating interest in creating a startup;

• for investors, London will still be a good place for creating startups, even after Brexit; and

• London might lose its leading role in Europe’s startup ecosystem, cities such as Paris will gain more traction.

The clients’ perspective

In the final session of the Conference delegates discussed what all lawyers in private practice should bear in mind.

Session Chair

Lise Alm Institute of Arbitration at the Stockholm Chamber of Commerce, Stockholm

Speakers

Andrea Gildea Head of the Legal of the Americas, TransferWise Inc, New York

Luisa Orre Chief Executive Officer, Glue, Stockholm

Bart Selden General Counsel, Taulia Inc, San Francisco, California; Committee Liaison Officer, IBA Corporate Counsel Forum

Key points from this session included:

• startup clients are tricky, demanding but inspirational. It is important to adapt, in order to understand client needs;

• as the people behind startups are inexperienced, they might not understand how the legal sector works; and

• identify the risks for startups, so the clients are a couple of steps ahead in consequences which might occur following certain actions.

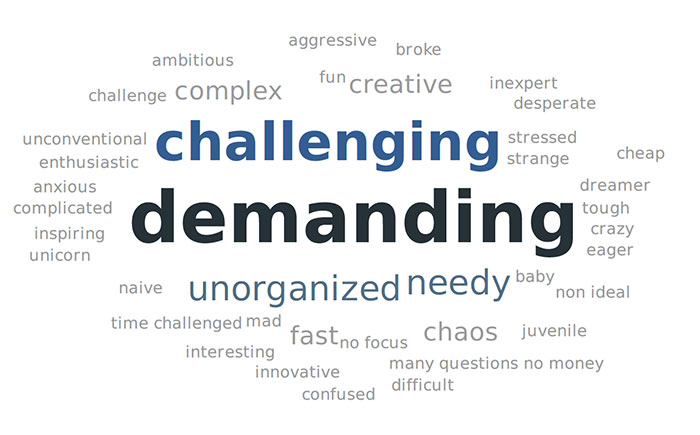

When the Conference audience was asked to describe a startup client in one word, the generated word cloud painted a picture of a somewhat strained relationship between external client and external counsel, with ‘demanding’, ‘challenging’, ‘unorganised’ and ‘needy’ being the principal words, with a just little touch of ‘creative’ and ‘fun’. Out of the 40 words generated, only four were unambiguously positive. The overwhelming majority were unambiguously negative.

The clients’ perspective on the lawyers, on the other hand, seem to be that they are an unnecessary evil costing too much money. A view that the firm seem to be rather familiar with judging from the answers to the question about which areas the expectations between counsel and the startup clients differed the most.

Had this been any other relationship, the combination of these results would imply that there is a break-up on its way, or is it that counsels involved in this sphere are just prone to suffering. Where or not this is true, it’s clear that legal sector does not always succeed in explaining its value to startup clients, and this is especially true if the client does not have a legal background. As the risk appetite in startup is generally very high, the value-add of reducing risk is not as strong a selling point as it might be for other clients, which also risks coming through in the risk level in the advice provided. The experience of clients, their pace and cost awareness also often differs from more mature companies.

This Conference specifically targeted startup lawyers, and 92 per cent of the audience believed the startup client is different from other clients, which would leave eight per cent thinking that all clients are disorganised and needy. Just under three-quarters of delegates (72 per cent) represented a firm with products specifically targeted at startups. It would be interesting to see what these offers are and how well they manage to bridge the gap described above. Something to be followed-up at future conferences.