Better safe than sorry: Risk management and dispute avoidance through efficient contractor due diligence

Friday 31 March 2023

Jeddah Tower, planned to be the first skyscraper to exceed 1,000 metres in height. Construction has been on hold since 2018. Credit: Leo Morgen

Bernd Ehle

LALIVE, Geneva

Alain Le Berre

Alebimta, Lausanne

Introduction

Construction projects can be derailed in many ways and end up in complex legal proceedings, for example, due to delays in execution or poor execution caused by liquidity shortages, possibly leading to severe issues or even insolvency of the contractor.

No employer likes to think about contractor failure or massive project overruns – and yet they happen regularly, and when they do, they can have massive negative consequences for the employer. This is unfortunate, because there are simple ways to avoid or efficiently mitigate such negative consequences by thoroughly vetting the contractor beforehand.

Employers should not only ensure that all risks are properly allocated contractually and that effective bank and/or parent guarantees are in place, but also conduct a rigorous due diligence review of the financial and commercial performance of all bidding contractors as part of their risk management procedures before awarding contracts.

It is well-known that cashflow is the ‘lifeblood’ of the construction industry. A contractor’s financial strength is as important as its technical skills and previous relevant experience. However, contractors often operate on razor-thin margins, even more so at a time of rising costs and widespread economic uncertainty, recently exacerbated by the Covid-19 pandemic, global supply chain disruptions, shortages of skilled staff and now significant inflationary pressures on raw materials and salaries, among other factors.

A contractor’s financial strength is as important as its technical skills and previous relevant experience.

Beyond a due diligence process that is strictly limited to a contractor’s financial statements, proper due diligence on corporate governance and execution risk can also serve as an important ‘insurance policy’ against financial misconduct or fraud that is otherwise not always readily apparent in the financial information provided to the employer.

This article aims to provide employers with a checklist for conducting comprehensive due diligence on contractors’ financial risks before signing a contract in order to avoid pitfalls.

Due diligence checklist for financial risks

In order to assess the risk of medium-term financial failure of a potential contractor, as well as possible execution and delay risks, employers need to have a comprehensive picture of the financial situation and prospects of the bidding contractors.

To this end, they should request that comprehensive financial documents (in particular, full audit reports including balance sheets, profit and loss accounts and cash flow statements for the last three years) and other key company information (minutes of general meetings and board meetings, if available) be posted in a data room as part of the tender documents. Any confidential issues that may arise (especially in the case of private companies) can be addressed by having intermediaries inspect the relevant documents.

An experience-based classification of contractors’ financial risks and the respective reasons for their significance

The contractors’ financial risks to be assessed are, in fact, a broad combination of different financial risk areas that need to be examined and analysed separately.

These different risk areas originate in different types of possible causes, show up in different indicators and warning signals to be aware of in different sources and interpreted differently; they run through different types of mechanisms and processes and at different speeds. Finally, they require different approaches and tools for risk mitigation.

The most commonly observed types of contractors’ financial risk areas can be usefully divided as follows:

• Financial risks related to the soundness of a contractor’s existing financing structure, that is. its expected ability to repay or refinance all its existing liabilities on good terms. The significance of this category of financial risk should be seen in the light of the fact that an unmanaged financial risk in this category can lead to one of the following consequences for each contractor:

- bankruptcy;

- the opening of certain preventive mechanisms available depending on the jurisdiction (eg, ‘sursis concordataire’ in Switzerland, ‘procédure de sauvegarde’ in France, ‘Schutzschirmverfahren’ in Germany or ‘concordato preventive’ in Italy), which in turn may lead to a court deciding to compulsorily release the contractor from some of its liabilities and/or from some of its contractual obligations towards the employer;

- a legally valid possibility for each contractor (if subject to such a preventive mechanism) to renegotiate material terms of the contract under the protection of a court in its respective home jurisdiction;

- the practical unenforceability of guarantees provided by some contractors (or their subsidiaries, affiliates or even parent companies).

• Financial risks related to a contractor’s financial performance as measured by recent business performance (based on financial indicators from their income statements (P&L) and cash flow statements) and other publicly available information in their annual reports or other public sources. The significance of this category of financial risk should be seen in the light of the fact that an unmitigated financial risk in this category may result in the following for any of the contractors:

- The same risks identified in the previous type of financial risk, that is, bankruptcy or the opening of certain preventive mechanisms, which in turn could lead to a court deciding to release a company from some of its liabilities and/or from some of its contractual obligations towards the employer and/or allow a company to renegotiate material contractual terms under the protection of a court in their respective jurisdiction and/or render the guarantees provided by some contractors unenforceable in practice.

- Even if a contractor remains solvent and continues to operate normally, this category of financial risks may result in the contractor no longer being able to perform its obligations and duties under the contract. Depending on the situation, it may also result in the employer being unable to enforce some or all of the agreed contractual penalties and guarantees – particularly if this could result in a contractor or guarantor being driven into insolvency and the penalty or guarantee becoming essentially worthless.

• Financial risks that may arise from a contractor’s recent operating track record and corporate culture, as well as certain characteristics of its respective corporate practices, trading practices or corporate values.

• Financial risks that may arise from poor, or lack of, corporate governance practices at the contractor.

• Financial risks that may arise from issues relating to key personnel of the contractor, that is, its employees, directors or otherwise contracted professionals who have a significant impact on the project and/or on the contractor’s ability to perform its contractual obligations.

The latter three categories of financial risk can be assessed using documents available in the data room or easily accessible through public sources and social media. Their significance for employers must be understood in light of the fact that unmitigated risks in this category for any of the contractors may not only result in delays or additional costs in completing the project but also in unplanned and unbudgeted additional operating costs for the employer that become necessary to address a delay.

• Financial risks that may arise from performance or execution problems, that is, the temporary or permanent inability of the contractor to fulfil its contractual obligations (in particular with regard to the nature, quality, timing or cost of certain works for which it is responsible) and/or to effectively implement the appropriate remedial measures required of it.

• Financial risks that may arise from problems related to contractual risks, that is, already identified or foreseeable provisions in the contract that may pose a downside risk to the timely and qualitative execution of the project at the agreed cost.

The assessment of a contractor’s financial risk can be based on two dimensions: (1) the likely probability of occurrence; and (2) the severity of the material financial impact if it were to occur.

The importance of the latter two categories of financial risks must be understood against the background that unmitigated financial risks in this category can lead to financial risks for the employer related to (1) additional costs incurred for appropriate remediation measures; (2) significant delays in the project and/or work interruptions; and (3) the practical enforceability and hence practical financial value of any agreed contractual penalties and guarantees.

Assessment of the significance of the identified financial risks

The assessment of a contractor’s financial risk can be based on two dimensions: (1) the likely probability of occurrence; and (2) the severity of the material financial impact if it were to occur. These can then usefully be presented in a matrix such as the one below.

Each of the above types of financial risk is now explained in more detail.

Financial risks due to considerations about financial reporting standards and usages

It is advisable to require significant contractors to ensure that the financial information they provide for the due diligence purposes has been prepared in accordance with appropriate financial reporting standards. Such standards ensure that their financial statements can be fully relied upon and that they are comparable to those of any external benchmarks against which the employer or a third party may wish to compare them.

The following financial reporting standards should always be required:

• The contractor’s auditors should be from the top tier of internationally active audit firms whose independence and quality standards and procedures are usually unquestioned (or, in the worst case, who have sufficiently large financial resources to be successfully sued for any damages). Smaller firms, while in some cases also able to provide impeccable (or even better) services, do not always enjoy the same reputation. Their auditing standards and procedures are not known to the public, they may or may not be good enough, and their independence vis-à-vis their (less numerous) clients may not always be guaranteed either.

• The contractor’s auditors have issued a so-called ‘unqualified’ audit opinion on the company’s financial statements. This means that the auditor has confirmed that the financial statements presented give a ‘true and fair’ view of the firm’s finances. If this is not the case, the reservations stated by the auditors must be examined in detail to determine how serious the reasons are that led them to withhold the unqualified audit opinion. Any qualification that is unclear or inadequately explained, or one that is repeated from year to year, should be considered a serious warning sign as it raises the possibility that the financial statements as presented by the contractor are not reliable.

• The contractor’s financial statements have been prepared in accordance with generally accepted accounting principles (GAAP). These are usually the International Financial Reporting Standards (IFRS) in Europe and US GAAP in the United States. In various countries there are other national accounting standards. In Switzerland, for example, the so-called ‘Swiss GAAP’, sometimes used by medium-sized contractors, or the even less demanding standards of the Swiss Code of Obligations (SCO), which are the bare minimum to ensure compliance with Swiss law and taxes, but which otherwise do not ensure that any kind of generally accepted accounting standards have been followed.

In the construction industry, most national accounting standards (including those of various European countries or, for example, the SCO) differ greatly from IFRS. Some national auditing standards are more susceptible to lower accounting standards and/or to deliberate manipulation. It is to be expected that financial statements prepared in accordance with IFRS will differ significantly from those prepared according to another reference system. For example, the most common differences between the SCO and IFRS accounting standards, which are often relevant in the construction industry, include the different treatment of revenue recognition, asset leasing and goodwill, the different treatment of deferred taxes (for example, there is none in the SCO) and the absence of certain explanations and details in the notes to the financial statements.

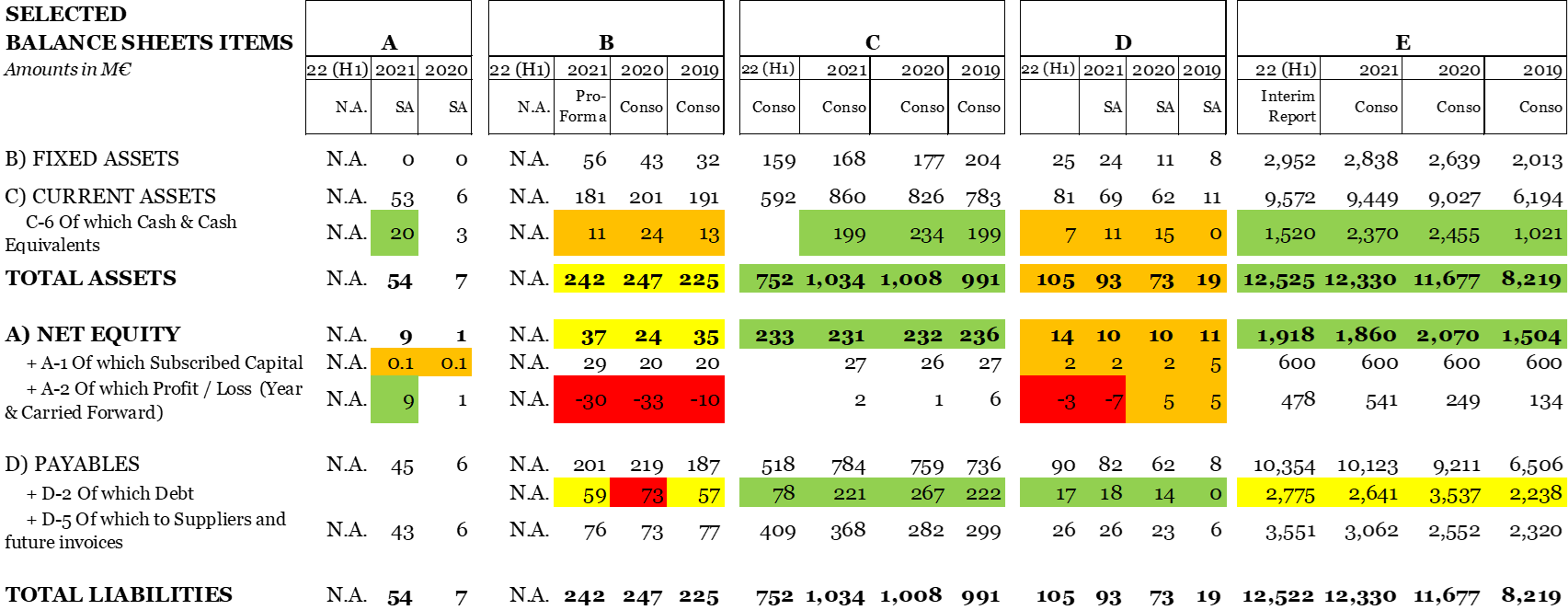

Financial risk from considerations about the financing structure soundness (capitalisation and asset structure)

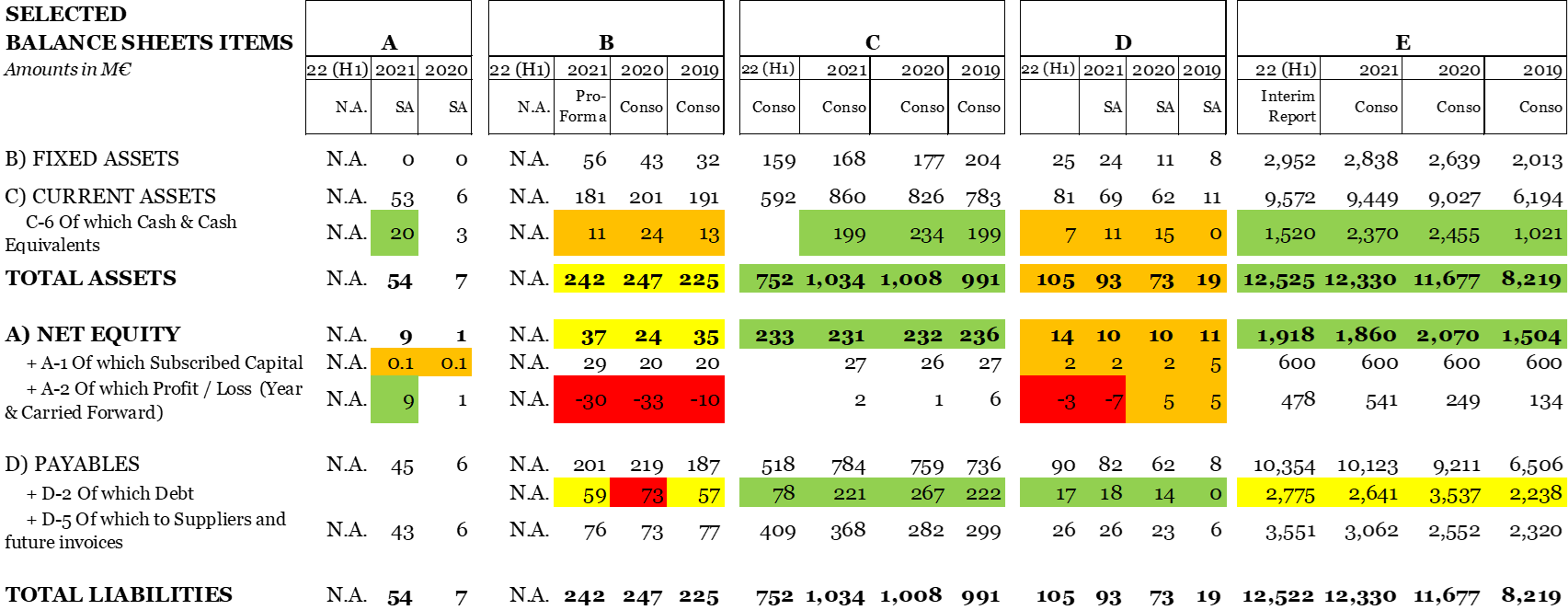

The assessment of this category of financial risks is mainly based on balance sheets where specific risk areas can be identified, and their potential severity assessed. Below is an example of the assessment of the soundness of the financial structure of four different contractors from a real matter.

In this particular case, it was found that only contractors C and E had a size that would normally be considered sufficient to take on construction projects of the size of the project awarded by the employer. In addition, contractors A, B and D appeared to be rather weakly capitalised and some of them had a history of accumulated losses and/or had minimal cash reserves.

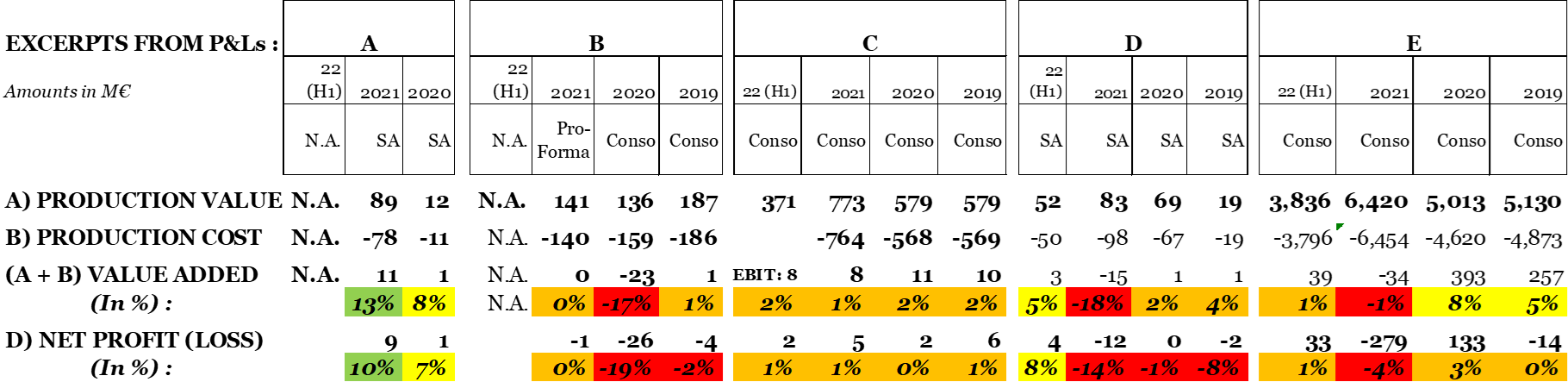

Financial risk from considerations about financial performance

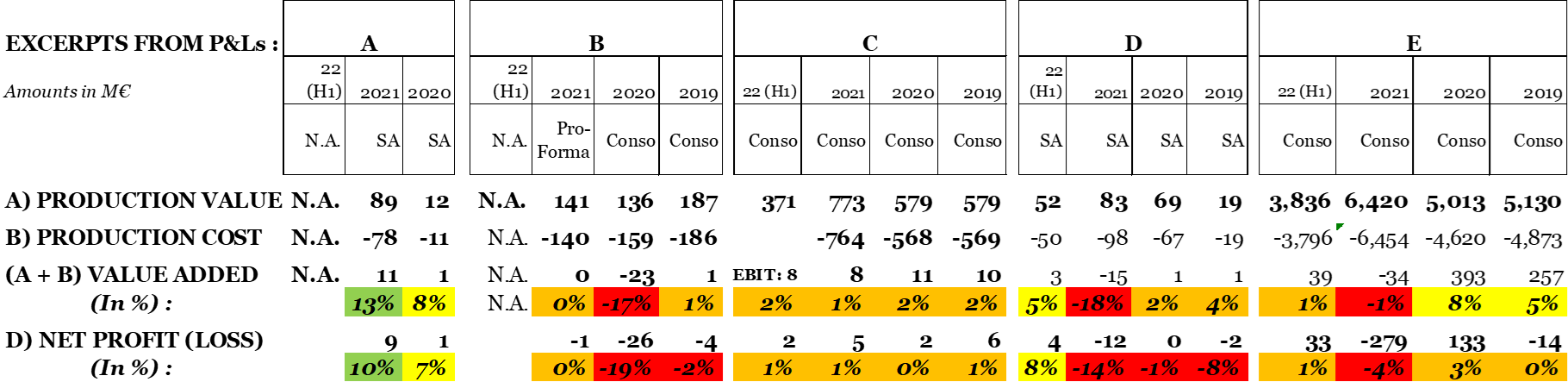

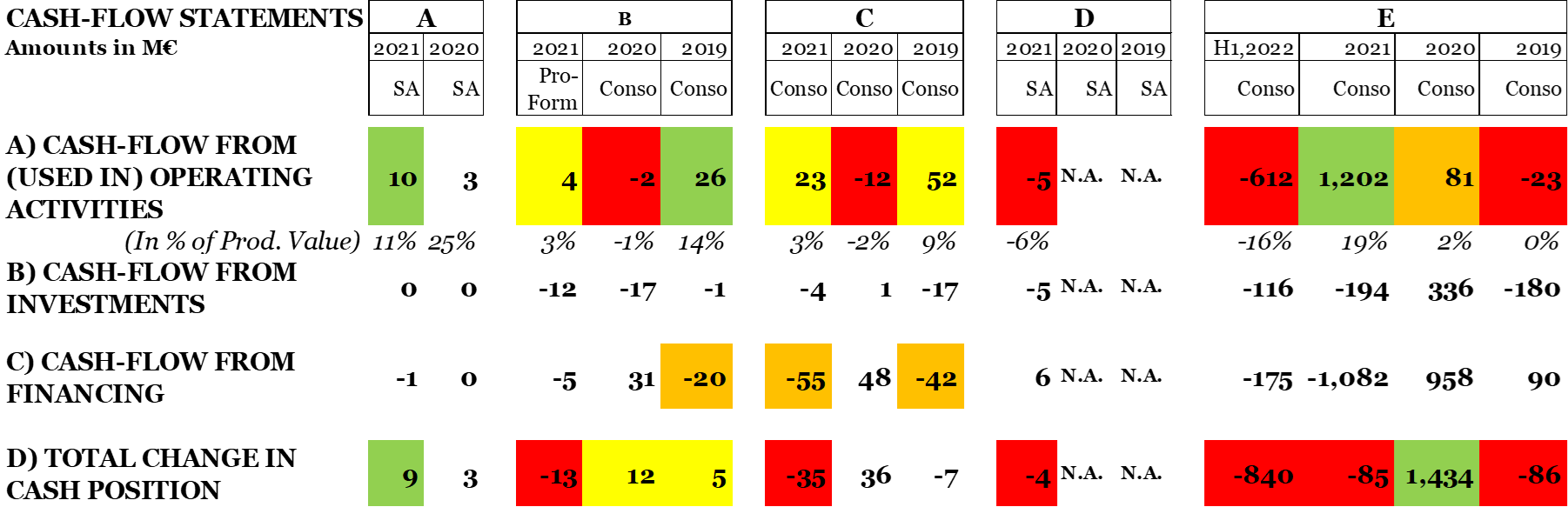

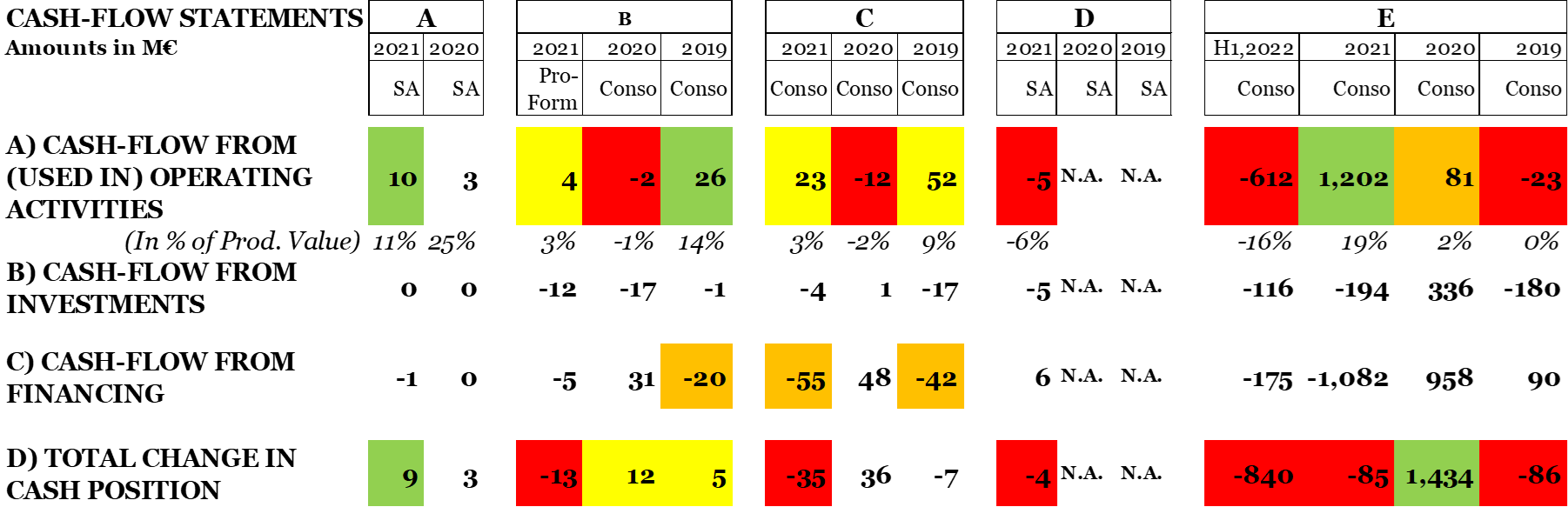

The assessment of this category of financial risk is mostly based on the profit and loss and cash-flow statements submitted by the contractors. An example drawn from the same real matter is shown below:

In this particular case, it was noted from the profit and loss accounts that all the assessed contractors operate on razor-thin margins (low single-digit percentages in both value added and net profit) and sometimes make significant losses, such as B and D in 2019 and in 2020 and E in 2021. Therefore, they could easily be knocked off their feet by a lopsided major project (both by the planned project and by another major project).

In addition, the cash flow statements noted that all the contractors assessed had unstable and/or weak cash flows from operations and that E was the only contractor with sufficiently high cash flows to normally be eligible for construction projects of the size of the project awarded by the employer.

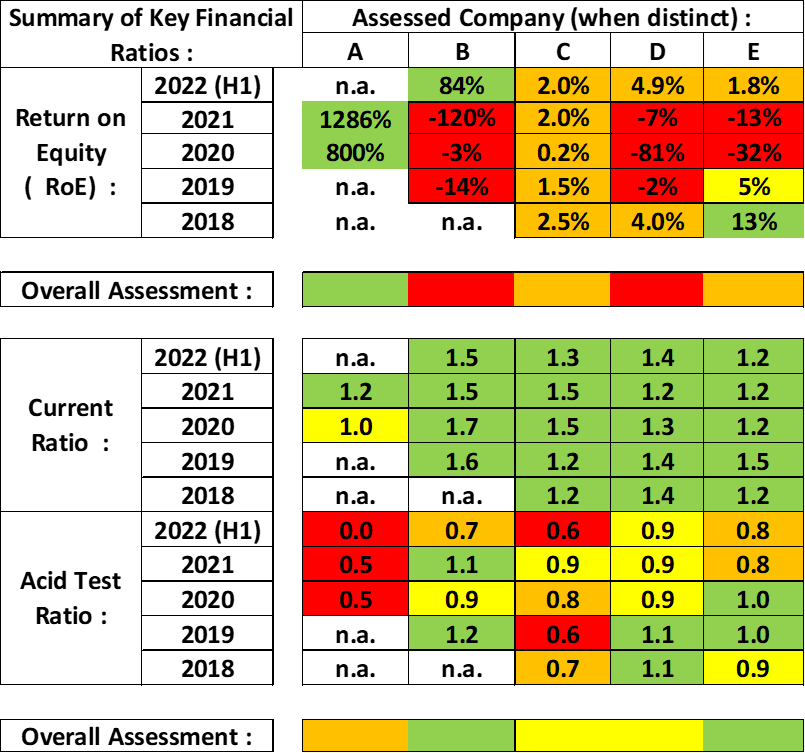

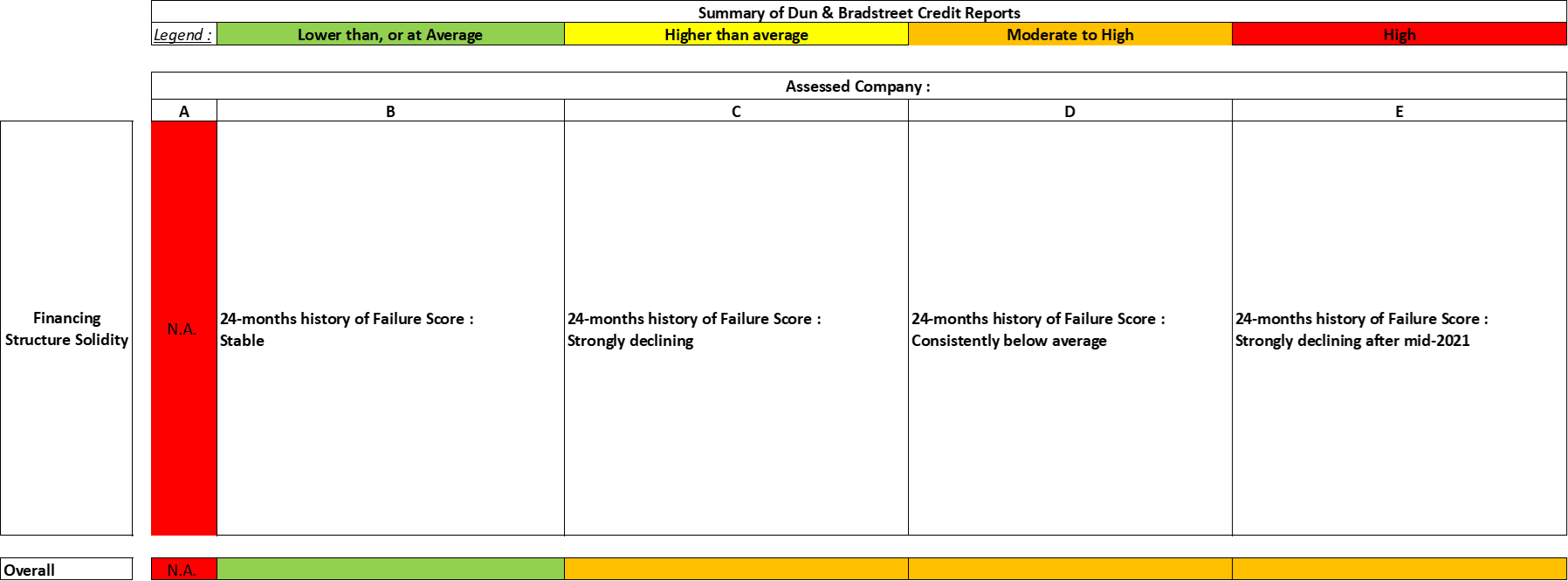

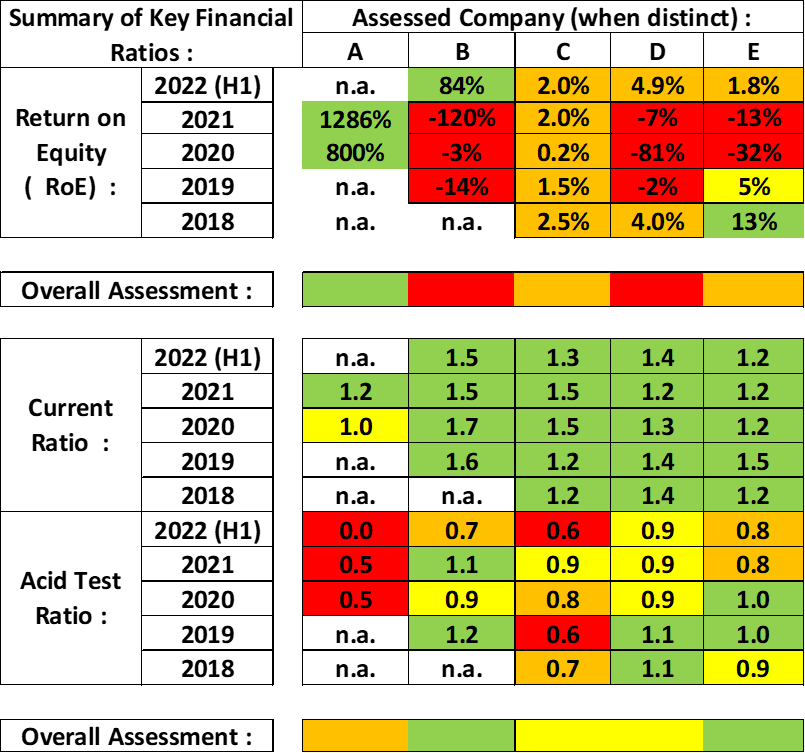

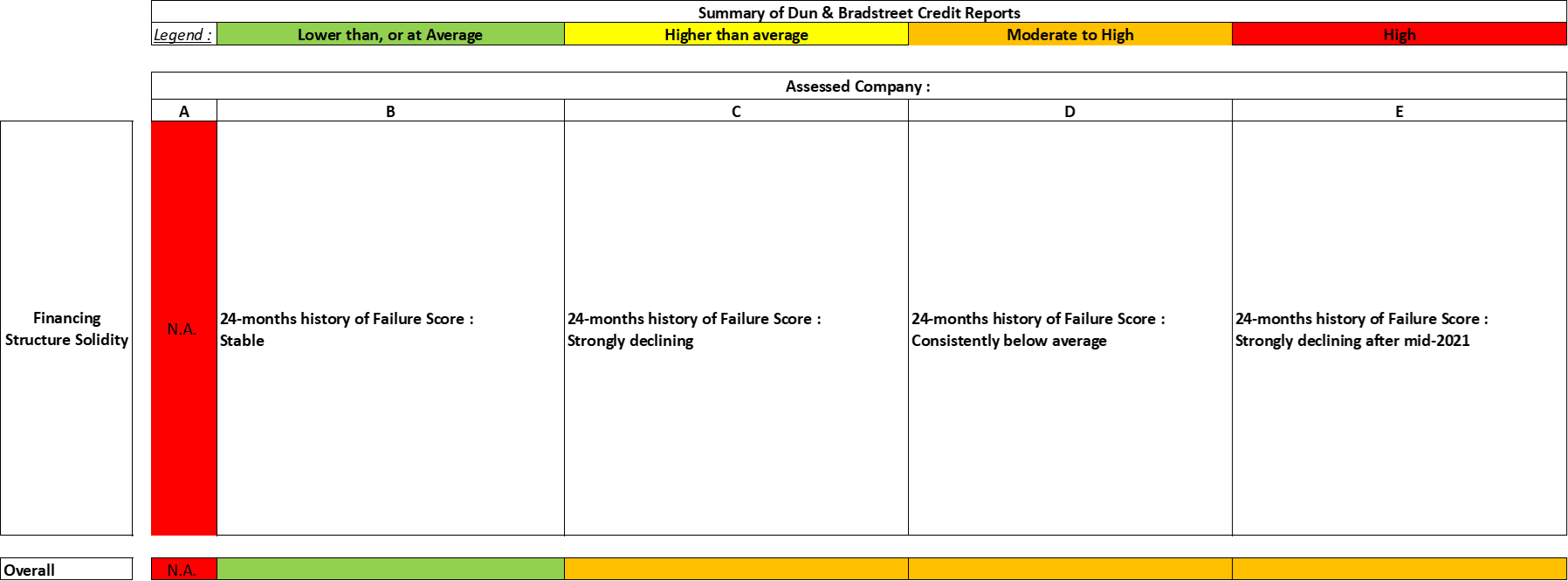

Use of externally generated credit reports

It can also be helpful to refer to credit reports prepared by reputable financial advisory/financial information companies, which include items such as failure scores, acid tests, current ratios, etc. Below are examples from the above-mentioned real matter using reports produced by Dun & Bradstreet:

Financial risk due to operational track record and company culture considerations

This type of risk can be assessed, amongst other things, on the basis of a contractor’s reputation and/or length of experience with construction projects of a similar type and size to the project to be awarded by the employer, but also on the basis of the existence of relevant quality insurance certificates and information that may be included in the notes to the financial statements or in the auditors’ reports.

Financial risk from corporate governance considerations

Apart from publicly available information (if any), this type of financial risk can also be assessed using annual reports, board reports, a detailed review of a contractor’s risk management procedures (sometimes described and commented on in detail in the notes to the financial statements and auditors’ reports). For example, in the case of one recent contractor, the notes to the financial statements and auditors’ reports highlighted a long series of areas where information was missing, disputes were ongoing or risks and uncertainties had been identified. In another case, it was a medium-sized multi-generational company where the family managers also played an important role in other areas (high-profile professional sports association, political mandates, etc.) and which was finally restructured after several years of repeated losses, although it was still open whether the improved financial performance would prove sustainable.

For these reasons, the financial risk based on corporate governance considerations was considered moderate for both. Another contractor failed to provide proper governance information and it was noted that his finances were managed by his parent company and that it did not appear to have its own finance department. As a result, for governance considerations, his financial risk was rated as significant.

Financial risk from key personnel considerations

It is always advisable to check a contractor’s key management and board members (in public sources and social media) to see if this indicates any problems. For example, it was recently discovered with a client that the list of key personnel for the project provided by a bidder in its tender documents consisted of the top management and key technical and commercial executives of the parent company. While it was positive that this would likely attract the attention of the project’s top executives, in practice they do not represent the key personnel who will ultimately be responsible for the success (or failure) of the project on the ground, and this was raised as a point of discussion to be explored further with the contractor.

Financial risk from execution risk considerations

Execution risk refers to the potential risk that a particular contractor runs into difficulties and is unable to fulfil its obligations towards the employer (in particular with regard to the budget and/or the schedule of deliveries). This can represent a significant financial risk for the employer and can be viewed from a number of angles: assessing the financial reliability of the contractor, the soundness of its financial structure, its financial performance, the operational track record and the corporate culture discussed above, but also previous experience of the employer or external references provided by the contractor for projects of similar type, geography and size.

For example, in a recent client project, information about a similar project currently underway was submitted late, incomplete, partly unfounded, and in an overly complex and contradictory manner. There seemed to be some resistance to disclosing the relevant information. Certain documents relating to the expected completion date of the current project were in fact ‘risk’ sensitivity analyses for possible scenarios (using Monte Carlo models), which resulted in very large differences in possible completion dates. This generated little confidence that the currently envisaged completion dates were considered realistic. In addition, a discussion with an external expert involved in the project indicated that the tender drawings appeared to have been used as execution drawings, without additional surveys of existing conditions and with little/no interdisciplinary coordination prior to installation on site; that work was proceeding without drawings submitted or approved; and that amendments were being made to the specifications without prior discussion or approval. As a result, in this particular case, the financial risk from execution risk was assessed as high.

Experience with previous client contracts has also shown that a significant financial risk from execution risk can arise when a new project (or project phase) is awarded to a contractor who is still carrying out a previous project for the same employer. Indeed, it can sometimes be seen in construction disputes that part of the advances paid for the new project were in fact used to cover losses from the previous project. This situation can lead to a shortage of funds at a later stage and eventually to a shortfall in the later phases. It may be difficult, or even impossible, to detect such undesirable developments before it is too late to stop them or rectify them in a satisfactory manner.

Although this may be considered fraudulent behaviour or mismanagement, it is unfortunately not that rare in the construction industry. It can either be the result of initially minor mismanagement on a project that eventually grows to the point where it cannot be remedied (hence the need for proper financial reporting and accounting), or it can be the result of deliberate manipulation on the part of a contractor’s top management – the latter sometimes being a delayed consequence of the former.

Financial risk from contractual considerations

This article does not aim to discuss contractual risks in general. However, some contractual risks identified by the employer’s legal counsel should sometimes also be considered when assessing financial risk. For example, in one project, the limitation of liability requested by a bidding contractor was found to have a potentially significant impact on the assessed financial risk. Another issue related to the practical enforceability of a joint and several liability agreed by several joint bidders and a parent guarantee provided by a major shareholder, particularly in view of a questionable financial structure, as highlighted above.

Risk mitigation strategies

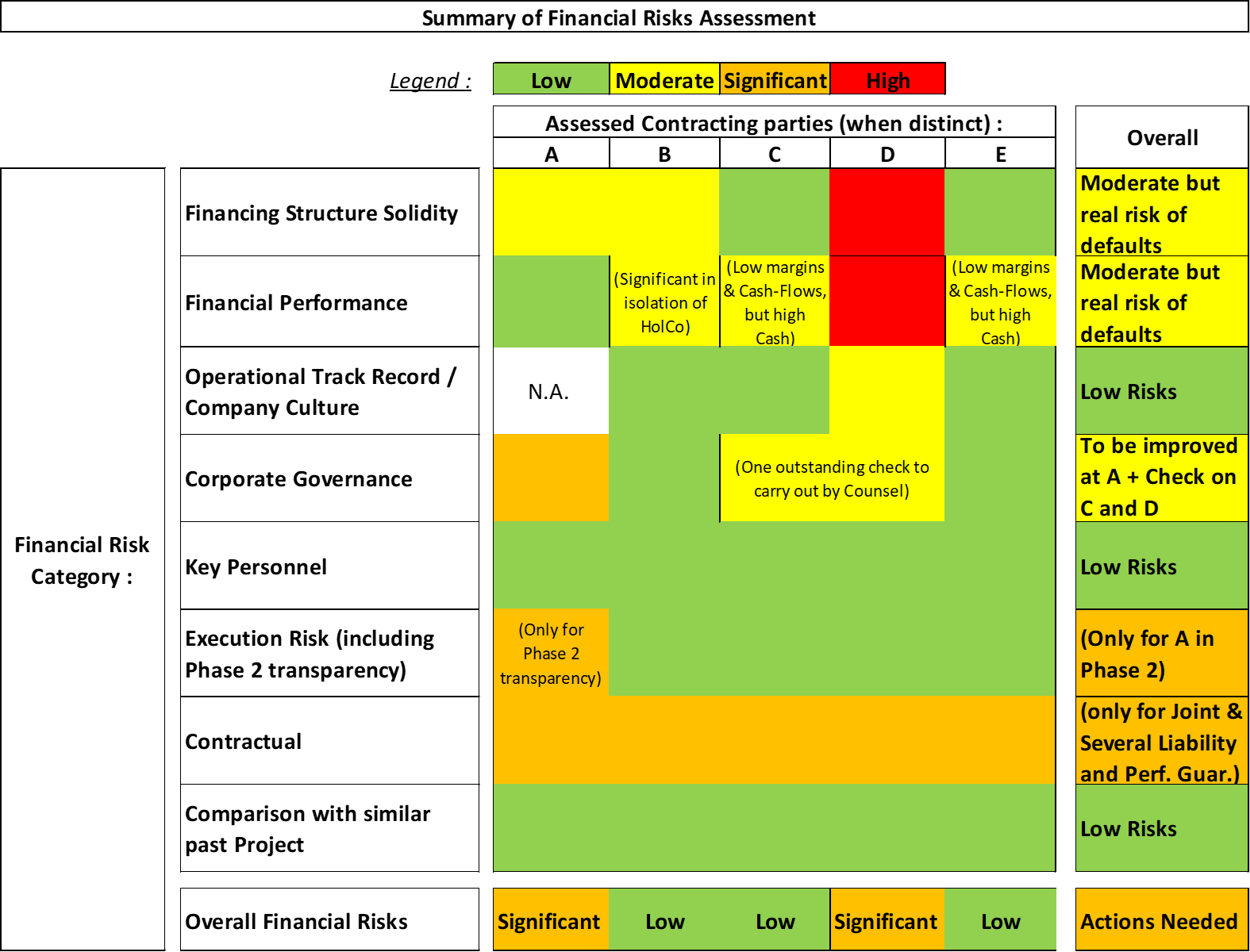

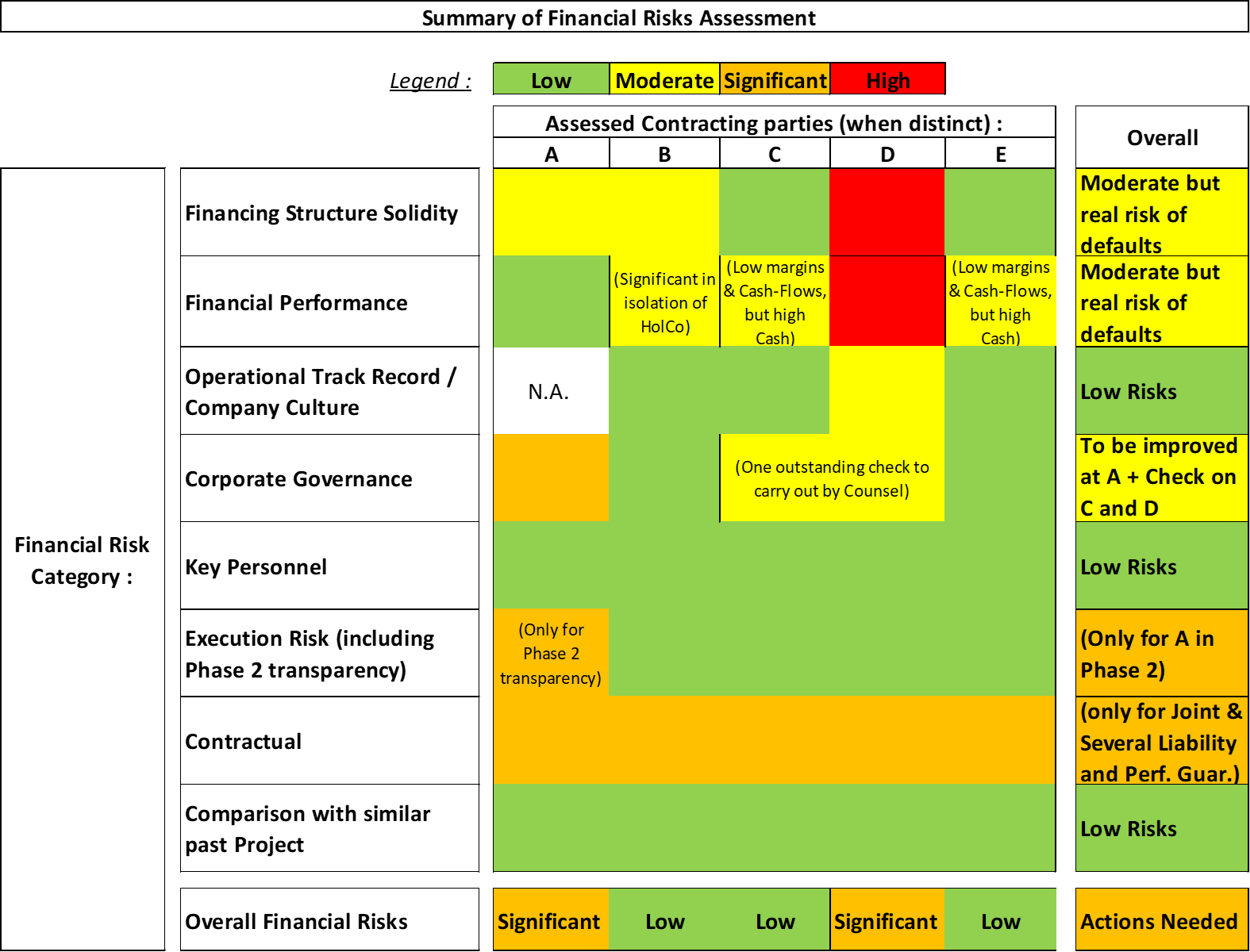

Once the various sources of financial risk discussed above have been sufficiently researched and assessed, it may be useful to summarise them in a summary table. An example of such an overview can be found below.

A financial risk assessment is even more useful to the employer if it is accompanied by proposals for risk mitigation measures for each identified financial risk, as shown in the following example.

Other aspects of an efficient contractor due diligence

This article focuses on due diligence in the areas of finance and corporate governance/execution risks. But of course, employers should also take into account many other legal and contractual considerations which, although not the focus of this article, are worth briefly recalling here:

• ensuring that the bidding contractor has a good reputation and is generally trustworthy;

• verifying the existence of relevant licences for the award of the contract;

• verifying compliance with laws and the contractor’s track record of (pending) legal disputes or fraud investigations involving the contractor or any of its affiliates;

The costs and slight delays associated with proper due diligence will always be incomparably lower than the costs associated with project failure or cost overruns

• collecting records of working relationships with other construction companies and contractors; and

• reviewing a contractor’s ‘digital capabilities’, that is, whether it can effectively navigate a project where modern digital technologies are used (eg, Building Information Modelling – BIM) and where a digital data environment is in place.

Conclusion

There is no 100 per cent protection against a contractor’s default or insolvency during an ongoing construction project. However, employers can – and should – mitigate these risks by conducting thorough due diligence on potential contractors before entrusting them with their construction project. The same applies to contractors, who should similarly conduct due diligence on their subcontractors.

The costs and slight delays associated with proper due diligence will always be incomparably lower than the costs associated with project failure or cost overruns – even if weighted according to their likelihood of occurrence, which is not very low, especially in times like these. In addition, such due diligence can also help to identify potential risks that can then be better mitigated through appropriate contractual clauses and guarantees and/or by ensuring that they are properly enforceable in a court of law or arbitration, thereby greatly improving the chances of success and reducing the costs of proceedings in the event of a dispute.

All in all, this is a wise investment for employers to make before awarding a contract: better safe than sorry!

About the authors

Bernd Ehle is a partner at LALIVE in Geneva and can be contacted at behle@lalive.law.

Alain Le Berre is a financial expert and founder of Alebimta in Lausanne and can be contacted at alb@alpaha-corporate-finance.com. |