Covid-19: Belgium's insurance market

Back to Insurance Committee publications

Hugo Keulers

Lydian, Brussels

hugo.keulers@lydian.be

Sandra Lodewijckx

Lydian, Brussels

sandra.lodewijckx@lydian.be

Alexander Hamels

Lydian, Brussels

alexander.hamels@lydian.be

The Covid-19 pandemic has had a significant impact on Belgium’s insurance market. The pandemic requires insurance undertakings and intermediaries to adapt to a changing regulatory environment and deal with forced operational changes. These include changes in the distribution model and urgent outsourcing arrangements. Furthermore, Covid-19 has an impact on portfolio and investment performance, affecting both sides of the insurer’s balance sheet.

Regulatory changes

Since the start of the Covid-19-virus outbreak, Belgian, European Union and international insurance regulators have taken various measures to respond to the crisis.

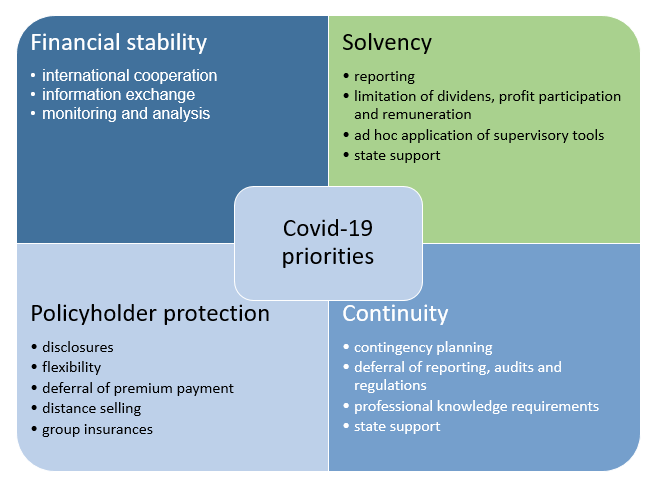

Regulators have prioritised measures relating to the protection of financial stability, the solvency position of insurance undertakings, the continuity of their operations and the protection of policyholders.

The competent national authority, the National Bank of Belgium (NBB) has taken different Coronavirus-related initiatives, such as the establishment of the Economic Risk Management Group (ERMG). The NBB has focused its supervision and regulation on critical and essential tasks relating to the impact of Covid-19. In particular, it has decided to:

-

suspend the NBB Insurance Stress Test 2020;

-

limit audits, prioritising them in connection with risks relating to Covid-19 and compliance with laws and regulations;

-

postpone the publication or application of certain circulars;

-

collect qualitative and qualitative data regarding the impact of Covid-19 on a weekly basis; and

-

collect data regarding possible intentions to distribute profits to shareholders and policyholders.

Furthermore, the NBB has implemented the European Insurance and Occupational Pensions Authority (EIOPA’s) various recommendations on Covid-19.

The Financial Services and Markets Authority (FSMA) has published a newsletter regarding the Covid-19 addressed at insurance intermediaries. The FSMA advises not to take any initiatives that could hinder business continuity of insurance intermediaries, such as comprehensive requests for information.

Fair treatment of consumers

In Belgium, the insurance sector has taken its own initiative to support policyholders affected by the Covid-19. Assuralia, the umbrella organisation for insurers and reinsurance operating in the Belgian market, has announced extraordinary measures to protect vulnerable consumers and companies. The initiative is supported by the NBB, the FSMA and the Belgian government.

In particular, the sector allows a deferral of repayment until 30 December 2020 for mortgage credit loans and loans to businesses, as well as a deferral of premium for group insurances, fire insurances connected to a mortgage credit and other B2B (business-to-business) insurances.

Solvency and capital position

The NBB has implemented the EIOPA’s recommendations with regard to the solvency and capital position of Belgian insurers. It has urged (re)insurers to suspend all dividend distributions and share buybacks until at least 1 January 2021, and to act in a prudent and conservative manner with regard to variable remuneration and profit share.

Claims

As a general observation, Belgian business interruption policies seldom provide cover for pandemics or communicable diseases. Indeed, business interruption cover usually depends on the condition of property damage. Only in exceptional cases do policies contain a specific extension for communicable diseases. Currently, there are no legislative or regulatory initiatives taken to make business interruption cover mandatory. The NBB and/or FSMA has not initiated any legal proceedings similar to that of the United Kingdom Financial Conduct Authority (FCA). Except for one important case in the area of event cancellation insurance, we are not aware of any pending court cases where the issue of cover due to Covid-19 is at stake.

Life and health insurers are generally paying indemnities in claims related to Covid-19.

Other types of policies, such as event cancellation insurance, generally contain exclusions for pandemics or, more generally, communicable diseases.

Nevertheless, it remains essential to examine the policy wording on a case-by-case basis. In practice, the parties will rely on Belgian civil law rules to interpret the insurance policy. This may lead to semantic discussions or a need for expert witness statements. The Law of 4 April 2014 on Insurance provides that, in case of doubt, the interpretation that is most beneficial for the policyholder prevails. However, the latter interpretation rule does not apply to large risks.

Back to Insurance Committee publications